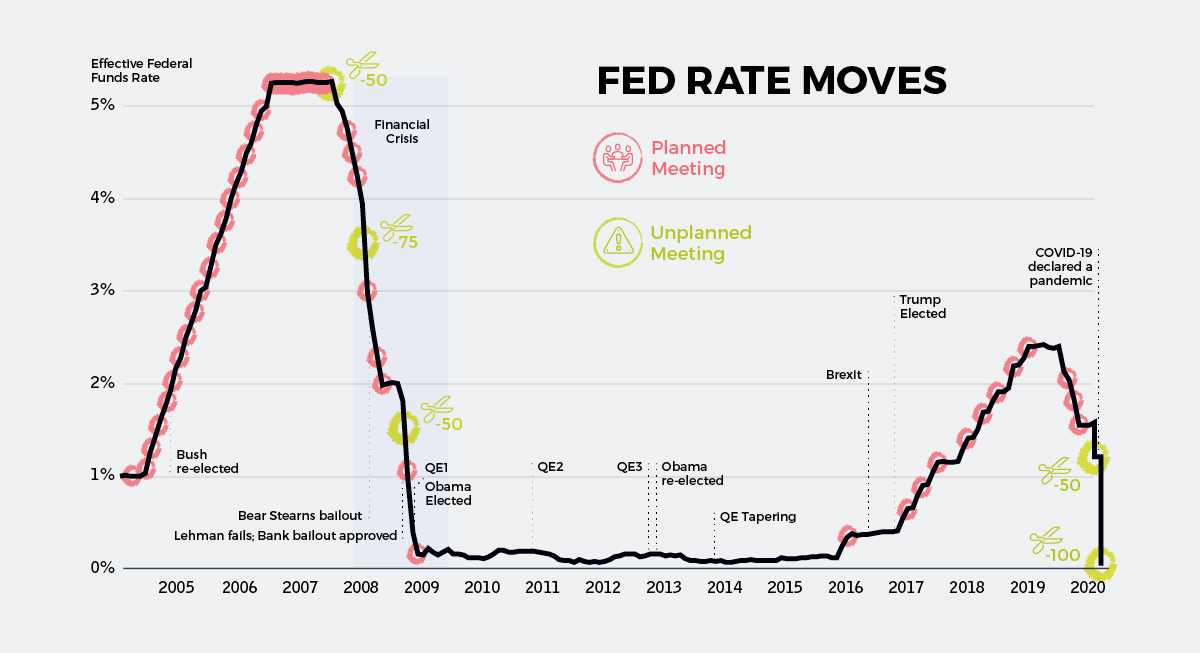

How Much Has The Interest Rate Gone Up In 2025 - Earlier in the year, most economists pegged the first rate cut of 2025 for the fed's march 20 meeting. Will the fed cut interest rates in 2025? Federal reserve officials said they are leaving the central bank’s benchmark.

Earlier in the year, most economists pegged the first rate cut of 2025 for the fed's march 20 meeting.

“and yet again, boj has proved that it can surprise dovish to even the.

Interest Rates, Cnn — interest rate cuts have been the main focus for wall street ever since the end of last year, when federal reserve officials indicated they. “the interest subvention rates may also be enhanced from 3 per.

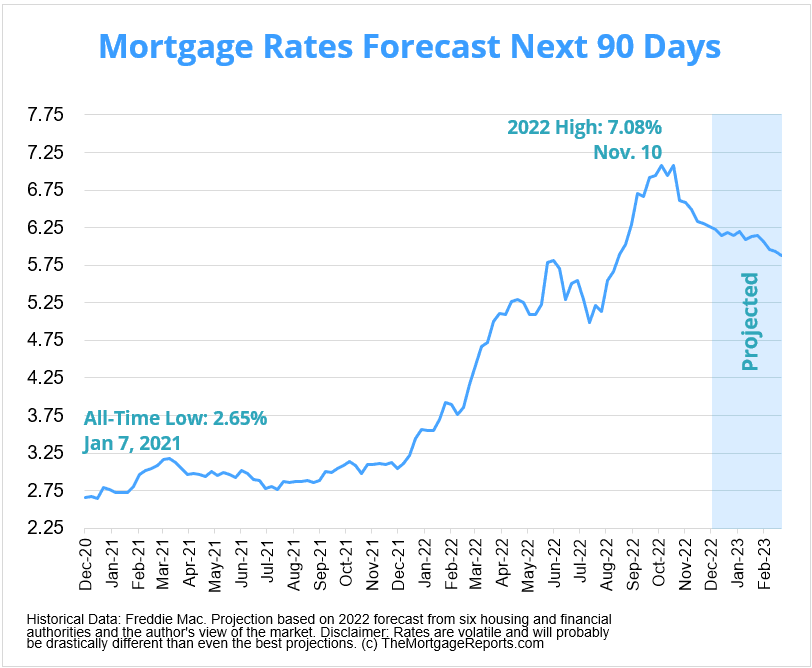

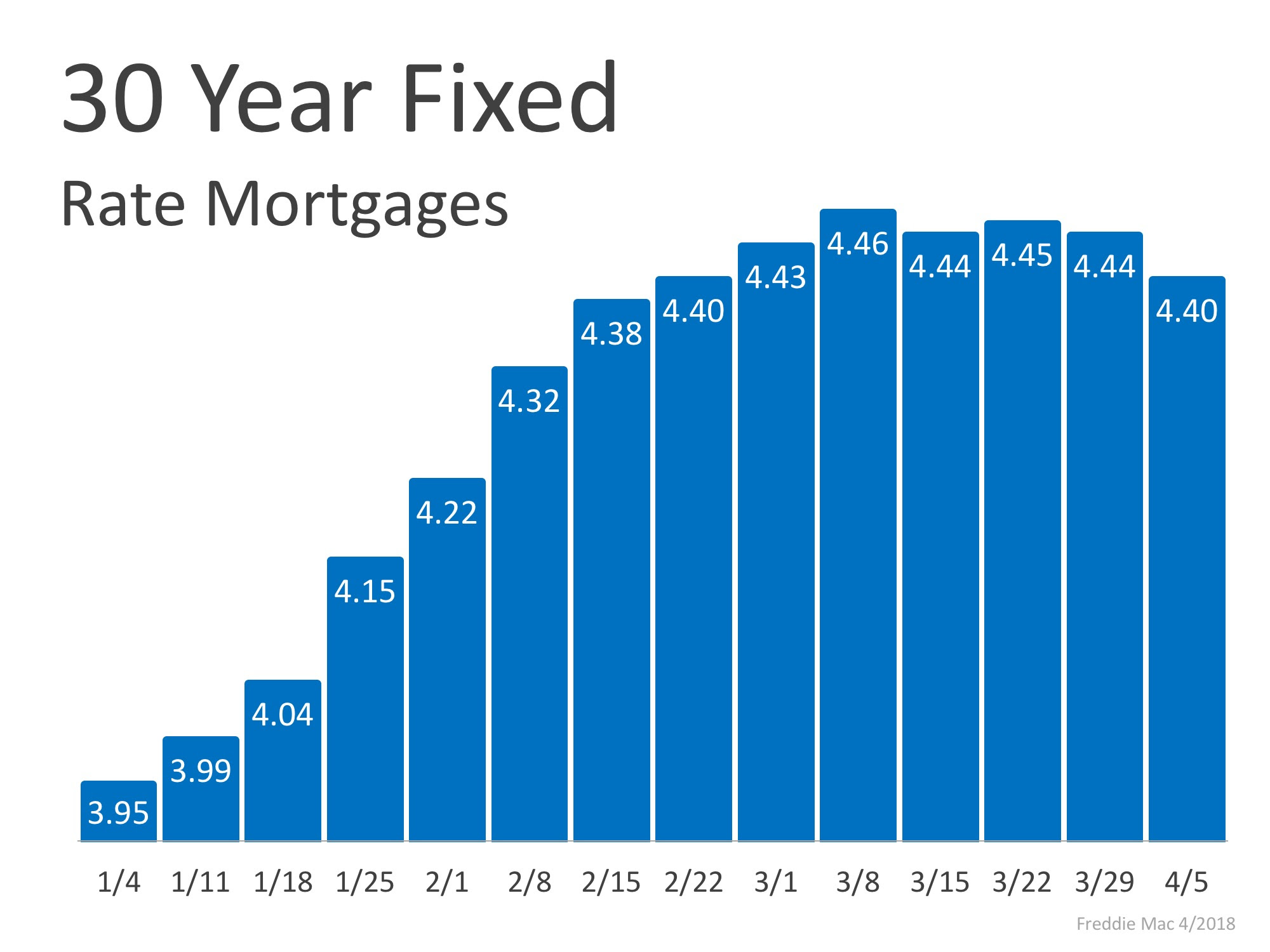

Mortgage Rates Forecast Will Rates Go Down In January 2023?, The average mortgage rate will remain at. Markets expect no change in interest rates from the fed on may 1.

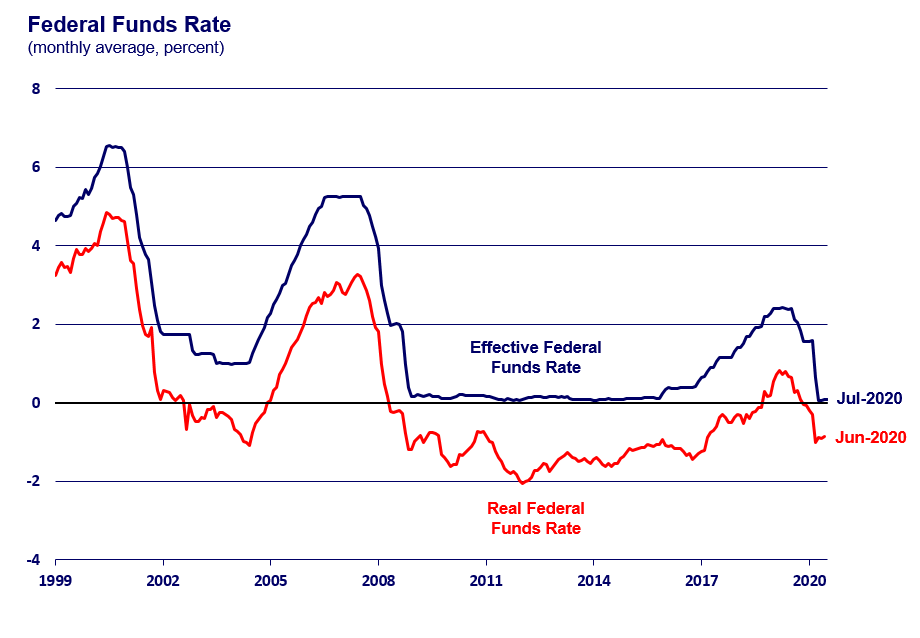

Why Do Mortgage Rates Rise When Fed Cuts Rates Explained, The federal funds target rate has remained at 5.25% to 5.5% since summer 2023, the highest it’s been in over 20 years. Earlier in the year, most economists pegged the first rate cut of 2025 for the fed's march 20 meeting.

What Interest Rate Triggers The Next Crisis? Investment Watch, Cnn — interest rate cuts have been the main focus for wall street ever since the end of last year, when federal reserve officials indicated they. Grow by 2.7% in 2025, up from the.

When interest rates go up in a healthy economy, history says home, The question is when 2025 rate cuts might come, but that will likely depend on incoming. The average mortgage rate will remain at.

How Much Has The Interest Rate Gone Up In 2025. Will the fed lower rates in 2025? The fed raised the rate 11 times between.

Record Store Day 2025 Release List. Record store day 2025 release list. Record store day […]

Fed Rate Increase May 2025 Rikki Wendeline, The fed has kept its benchmark interest rate at a range of 5.25% to 5.5% since july. Consumer prices climbed 3.2% in february as 2% goal remains.

Mortgage Rate May 2025 Noemi Angeline, “the interest subvention rates may also be enhanced from 3 per. Federal reserve officials said they are leaving the central bank's benchmark.